Publisher: Structure Research

Analyst: Sacha Kavanagh

Summary: We caught up with management at European edge data centre operator AtlasEdge to get an insight into its strategy, infrastructure and the rationale behind its recent acquisition of data centres from Colt DCS.

Strategy: AtlasEdge was born out of a perceived need to bring compute architecture closer to where the workload comes together, to do so in a way that makes sense for the customer and to monetise it effectively. The combination of Digital Bridge and Liberty Global brought together data centre and carrier expertise as well as LG’s extensive physical footprint. Key members of the leadership team and senior management come from Interxion, and in a sense AtlasEdge is replicating the Interxion-type model as compute moves further to the edge. In the early days of the data centre industry, Equinix (via IXEurope and Telecity) and Interxion began developing what became carrier hotels to facilitate connectivity to multiple networks, thereby creating valuable ecosystems of connectivity providers and customers using that connectivity within their data centres. Recognising this was very difficult for others to replicate, they set about extending those ecosystems or ‘communities of interest’ to enable anyone in the data centre to connect to anyone else, down to specific industry ecosystems for industries such as financial services. That process continues. AtlasEdge wants to do the same for the edge: bring together all the different players that will enable a particular use case (networks, CSPs, SIs, enterprises etc) that will need to be in the same location and interconnect with each other. Equinix and Interxion can be thought of as international aggregation hubs, while AtlasEdge aims to meet the need for regional and even local aggregation hubs.

Demand: AtlasEdge was created in anticipation of a future wave of demand but management is seeing demand earlier than expected, driven to an extent by Covid-19. Interest is coming from the enterprise segment – especially manufacturing, logistics and retail – where a lot of compute is still done on-premise. The IT stack that was developed to do one particular task now needs to handle multiple different workloads, and it was built on the assumptions that networks are unreliable and expensive. These types of customer are looking to move compute away from the premise to a location that is in proximity and where they can build an edge compute stack able to serve multiple sites. These are customers that will need multiple proximate locations in one or more countries.

Infrastructure: Management describes the LG assets as an eyeballs network. There is an extensive data centre footprint which is now operated by a data centre specialist and, for the first time, will be available to external customers as carrier-neutral facilities. Across Europe it has over 100 data centres and several hundred more sub 1MW locations that have the right architecture to support edge requirements. All are existing buildings with power and connectivity. Some have available white space ready to sell, many of the sites can be extended within the building or the land footprint. AtlasEdge is in the process of evaluating modular data centre providers as one option for expansion.

UK footprint: Management clarified that the 25 main locations it has in the UK are all data centres, and that the other locations showing on its coverage map (well over 100) are all sites where it can stand up capacity (likely all sub-1MW). The data centres are in large cities (in London but also across the UK) where AtlasEdge expects the first wave of demand for aggregation and interconnection. Management would not confirm its total capacity in the UK, but said it was a substantial amount of MW, with a substantial portion of that outside London.

Colt DCS: With a significant amount of infrastructure already in place, why did AtlasEdge acquire 12 data centres in 11 European cities from Colt DCS? The Colt facilities are highly connected and enable AtlasEdge to build a hub and spoke architecture between its access edge locations and aggregation/interconnection hubs.

Scale: At the moment the infrastructure is concentrated in the UK, Switzerland, Ireland and Poland via the agreements AtlasEdge has with LG operators in those countries. It has an ambitious goal of getting to several hundred data centres and several thousand access edge locations in 11 markets within a year. It is already in those markets with the Colt DCS acquisitions, but will need to go far deeper. Management alluded to discussions with LG, which also has operations in Belgium, the Netherlands (via a 50:50 JV with Vodafone) and Slovakia (unlikely to be a high priority for AtlasEdge). Other M&A/partnerships will be needed if AtlasEdge is to get into key markets like France and Germany.

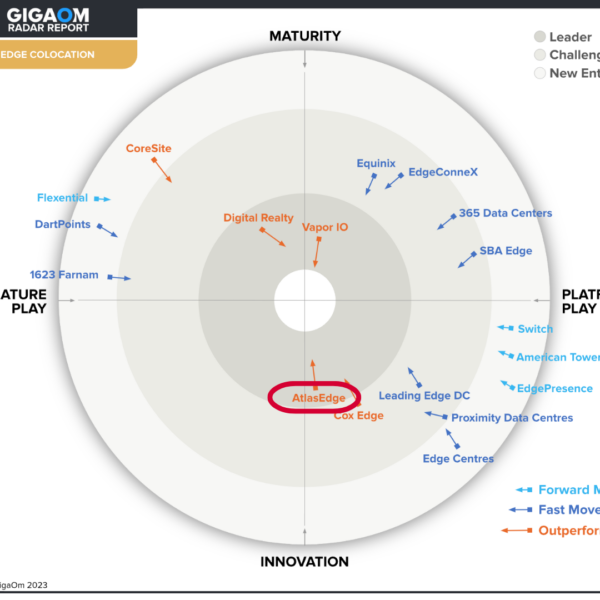

Angle: Management acknowledges AtlasEdge is just starting and that there is a lot of work to be done. It is already working with customers on POCs. Work is underway to ensure the infrastructure is managed effectively and cost effectively so the company can deliver a seamless customer experience at an appropriate price point. And discussions on future M&A are also in hand. Management eschews describing AtlasEdge as unique, but the truth is there is no other company out there with the depth and breadth of coverage in Europe. AtlasEdge has an experienced management team, credible and well-funded owners, and anchor tenants and revenue streams from both the LG infrastructure and Colt DCS assets. And it is in discussions with potential customers earlier than envisaged. A very interesting one to watch. Also interesting to see if this is a model Digital Bridge or someone else might look to replicate in other parts of the world.

About Structure Research

This article has been published with kind permission of the author, Structure Research.

Structure Research is an independent research and consulting firm with a specific focus on the cloud and data centre segments within the Internet infrastructure market. We are devoted to understanding, tracking and projecting the future of infrastructure service providers.

Our mission is to publish the best research and analysis, and supply the most comprehensive data sets, about the Internet infrastructure services market. We provide the information and perspective necessary to make accurate strategic decisions.

For more information and extensive resources, please visit: https://structureresearch.net/